Budget Overview

What is the City budget?

The City of Pleasanton’s budget is a plan for how the City will spend money. The City’s budget reflects the city’s operational needs, strategic goals and the values and priorities of the City Council and the community. The budget includes line items for both operational expenses (for example, librarian salaries) and capital expenses (for example, concrete to pave streets).

For information on the upcoming 2-year budget process, visit the Budget Development webpage.

What services does the City provide?

City funds are used to provide a wide variety of services and programs to residents and businesses.

These services include Public Safety (Police, Fire and Emergency Services), Public Works (street maintenance, park and trail maintenance, etc.), Water, Sewer, City Planning, Building and Safety, Code Enforcement, Housing, Economic Development, Parks and Recreation, Library and Transit. Funds are also used to design, develop and maintain city infrastructure (streets and roads, parks, facilities, etc.).

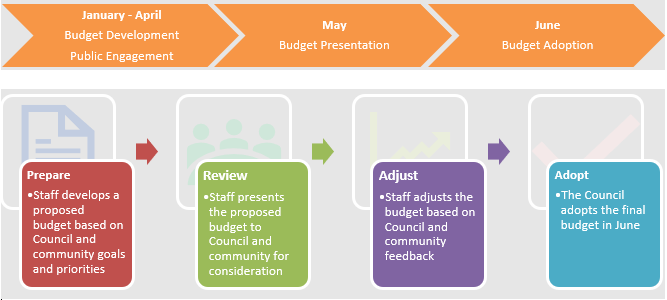

What is the City’s budget process? The City operates on a two-year (biennial) budget cycle. Prior to July 1st of every odd numbered year, the City Manager submits to the City Council a proposed budget for the next two fiscal years. The budget includes revenue (income) and expenditure (spending) projections and has two parts: the operating Budget and the Capital Budget. Every two years the budget is reviewed and updated.

What is the City’s budget process?

The City operates on a two-year (biennial) budget cycle. Prior to July 1st of every odd numbered year, the City Manager submits to the City Council a proposed budget for the next two fiscal years. The budget includes revenue (income) and expenditure (spending) projections and has two parts: the operating Budget and the Capital Budget. Every two years the budget is reviewed and updated.

For information on the upcoming 2-year budget process, visit the Budget Development webpage.

What is the City Council’s Role

The City Council’s role is to set goals and priorities and expected service levels.

What is the City Manager’s Role

The City Manager’s role is to submit a balanced budget reflecting the City Council and the community’s strategic goals, values and priorities.

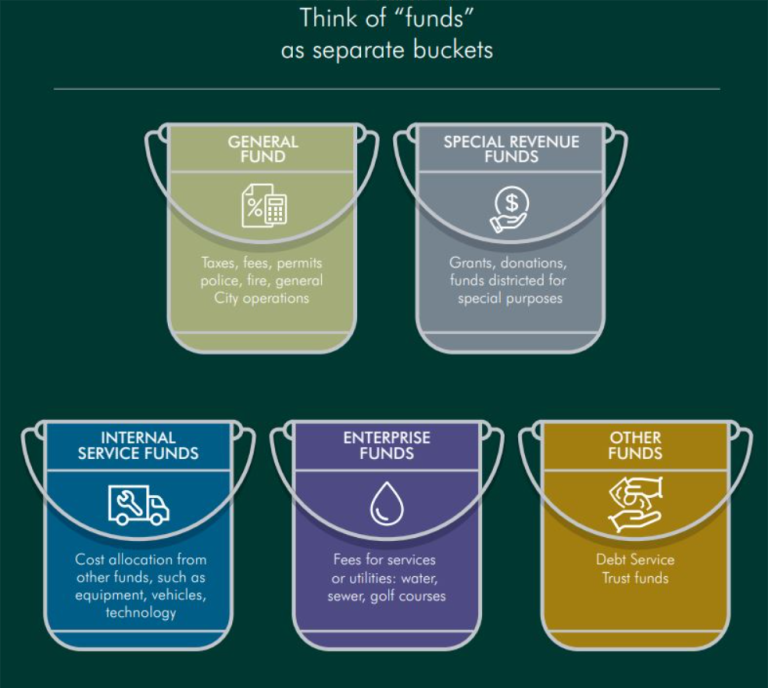

What is the General Fund?

The General Fund is the primary operating fund of the City. General Fund revenues (income) can be used for any city expense.What is a special fund?

Unlike the General Fund, special funds are restricted for specific purposes. For example, grant funds can only be used for projects or programs specified by the funding agencies that issued the grant.What is the difference between the general fund and enterprise funds?

The difference between the general fund and enterprise funds is the nature of the service they support and their funding sources. The general fund supports the overall operations of the government and relies on a mix of taxes and other general revenue sources, while enterprise funds are dedicated to a specific self-sustaining activity (such as water utilities); therefore, any revenues generated, typically by user fees or service charges, are restricted and can only be used for the operation and maintenance of that activity/service.FAQs

How are City budgets different than private sector budgets?

The City of Pleasanton is a public entity that manages its monies as governed by the Generally Accepted Accounting Principles (GAAP) established by the Governmental Accounting Standards Board (GASB). A public entity must ensure appropriate use of public funds. Local city budgets are subject to legal constraints and regulations regarding how funds can be raised and spent. Different categories, or “buckets” of public funds must be used in accordance with the restrictions and requirements of the specific funding category and funding sources may not be interchangeable, depending on the use.

Private sector budgets are primarily accountable to shareholders, investors, or owners and the level of transparency and scrutiny may vary depending on the nature of the organization.

What are the different categories of public funds and how can they be used?

What is the General Fund?

What is a special fund?

What is the difference between the general fund and enterprise funds?

What is the difference between “one-time” and “ongoing” funding?

What is the Operating Budget?

The Operating Budget focuses on essential city services such as police and fire, community services, community development, economic development, and sewer and water operations. Costs include personnel costs, annual facility/system operating costs and other operating expenses. These expenses are funded largely by tax revenues, fees and charges, interest income, intergovernmental funds and other smaller sources of revenue.

What is the Capital Budget?

The Capital Budget focuses on the design, construction and maintenance of city infrastructure. The city develops a four-year Capital Improvement Program (CIP) to plan for these costs. Funds are assigned in the budget to cover the first two years of the plan and the remaining two years are presented for planning purposes. Capital investments are critical in building and maintaining infrastructure to support a livable, vibrant community.

When is the City’s fiscal year?

What is the largest revenue (income) source in the City’s General Fund?

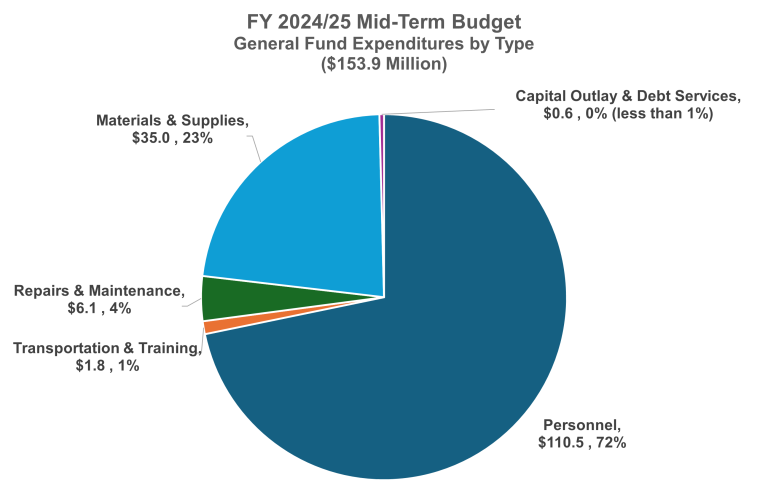

What is the biggest expenditure (expense) in the City’s General Fund?

Where do City funds come from?

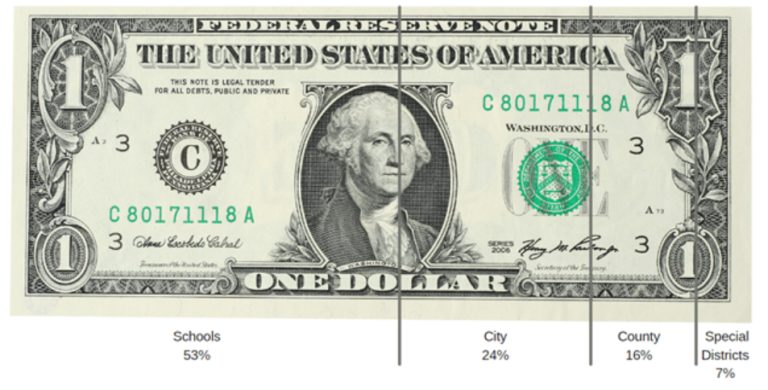

Where does your property tax dollar go?

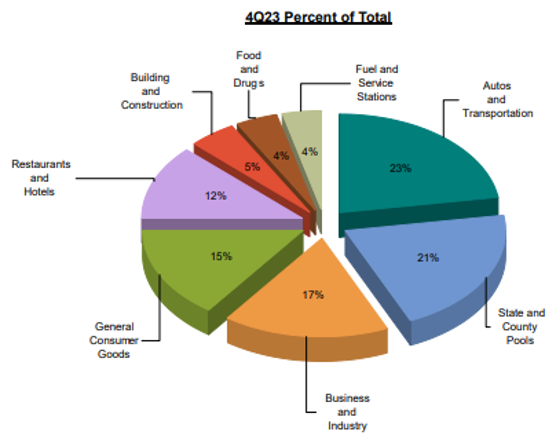

What are the City's sales tax revenues by category?

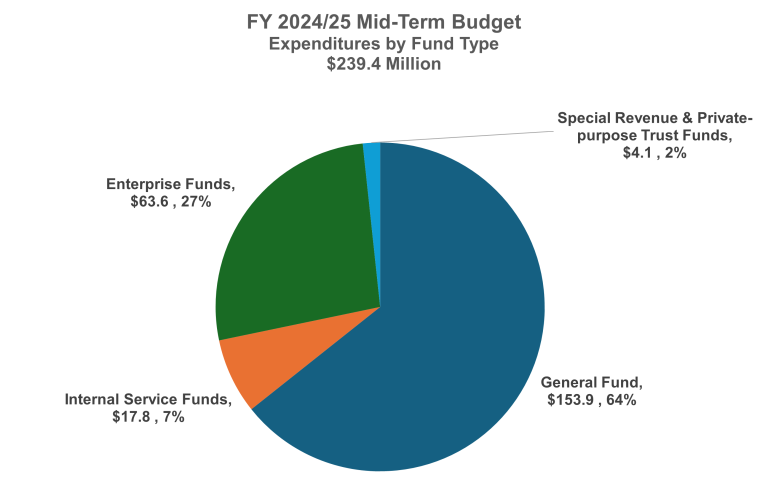

What do City funds pay for?

Financial Forecasting & Assumptions

A financial forecasting model is not designed to hit every number perfectly; it’s designed to show a trend. Pleasanton’s trend is a significant structural deficit.

The City uses reasonable assumptions for revenue and expenditure projections when developing financial assumptions. Revenues are projected conservatively and costs are projected less aggressively.

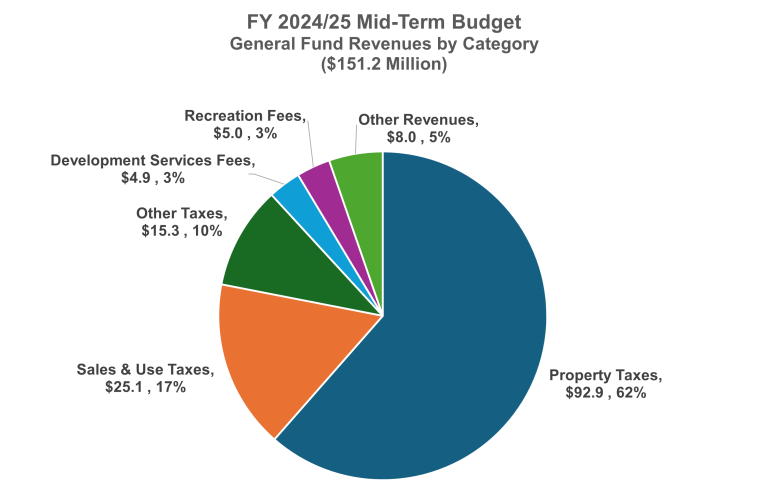

A revised property tax projection for the year ahead shows about 4% growth. While this is slightly higher than the assumption of 3.5%, it does not account for the likely downward adjustments we expect to see in the commercial market in the coming years, and will not address the significant projected structural deficit the City faces.

As part of the financial forecast, the City assumed employee costs would go up 3% per year for the next 10 years (starting in fiscal year 2024). Recent contract negotiations saw significantly higher increases over a three-year period. Additional contract negotiations for two labor groups will take place in 2025.

Pension Liability & Section 115 Trust

As part of the City’s commitment to long-term financial stability, Pleasanton has been addressing its unfunded retiree medical and pension liabilities, which exceed $200 million. To help manage these obligations, the City established a Section 115 Pension Trust in 2018. The trust now holds $51.1 million, serves as a buffer for rising pension costs, and has been prudently managed to avoid depleting funds prematurely.

Financial advisors, including an actuarial consultant, have recommended the City refrain from using these funds in the near term to bridge the budget deficit as aggressive use of the trust could hinder the City’s ability to meet future pension obligations, particularly during the peak contribution years that are still ahead. Maintaining a disciplined approach to this resource ensures the City will be better positioned to meet its long-term financial obligations without compromising essential services. Pulling investments early will defeat the purpose of investing and accruing the benefits over time.

Pleasanton's Infrastructure Funding Gap at a Glance

The City provides essential public services and develops infrastructure (facilities, parks, streets, pipes, etc.) that maintain and protect the community’s high quality of life. The City faces challenges with both the operating budget and capital budget. Aging infrastructure and limited resources to repair and replace them have increased the City’s infrastructure funding gap over the years. A high-level infrastructure assessment showed that the City’s unfunded needs are approximately $900 million over ten years.

Damages from the 2023 winter storms further increased the funding gap. Over $18 million in capital project funding, including funding for the Skate Park expansion and Century House renovation projects, was diverted to fund safety-related storm drain projects.

With the deferral/defunding of capital projects to fund critical storm drain projects, the City is further behind in developing and replacing its aging infrastructure. The City’s infrastructure will continue to age and deteriorate without a significant infusion of new revenue resources, especially with capital costs continuing to grow.

For more details, please refer to the FAQs on the City’s Revenue Measure Feasibility webpage.

City Budget

- 2024/25 Mid-Term Update

- 2023/24 and 2024/25 Budget-in-Brief

- 2023/24 and 2024/25 Operating Budget

- 2022/23 Mid-Term Update

- FY2021/22-2022/23 Pleasanton Budget in Brief

- 2021/22 FY and 2022/23 Operating Budget

- 2020/21 Mid-Term CIP Update

- 2020/21 Mid-Term Update

- 2019/20 and 2020/21 Operating Budget

- 2018/19 Mid-Term Update

- 2017/18 and 2018/19 Operating Budget

- 2016/17 Mid-Term Update

- 2013/14 and 2014/15 Operating Budget

- 2015/16 and 2016/17 Operating Budget

- 2014/15 Mid-Term Update

- 2011/12 and 2012/13 Operating Budget

- 2012/13 Mid-Term Update

- 2009/10 and 2010/11 Operating Budget

- 2010/11 Mid-Term Update