Finance Department

The Finance Department is responsible for the safekeeping, accounting and management of the city’s financial assets.

- Provides City Financial information to the public, the City Council, the City Manager and city departments

- Audits revenue sources

- Processes cash receipts, payroll and accounts payable

- Administers assessment districts and other debt

- Invests the City’s funds

- Monitors the City’s budget

- Coordinates the City’s Financial Audits

City Budget

The City of Pleasanton’s budget is a plan for how the City will spend money. The City’s budget reflects the city’s operational needs, strategic goals and the values and priorities of the City Council and the community.

The budget includes line items for both operational expenses (for example, librarian salaries) and capital expenses (for example, concrete to pave streets).

Financial Reports

The City of Pleasanton produces various financial reports, which include the Annual Comprehensive Financial Report (ACFR) and Popular Financial Report (PAFR). The ACRF provides detailed financial information about the city’s activities over the course of a fiscal year.

The PAFR provides a simplified overview of the government’s finances, by promoting transparency, accountability and public understanding of financial activities.

Regional Project Funding

There are several sources of funding used for Capital Improvement Program (CIP) projects, some of which have special reporting requirements.

Measure B & BB Funding

- The ballot measure, Measure B, was overwhelmingly approved by county voters in 2000. The half-cent sales tax authorized by the 2000 Measure B will be in effect for 20 years; sales tax collection began on April 1, 2002 and will extend through March 31, 2022.

- The ballot measure, Measure BB, was approved by 70% of county voters in 2014. The sales tax authorized by the 2014 Measure BB will be in effect for 30 years; sales tax collection of a half cent will begin on April 1, 2015 and will extend through March 31, 2022. The full one-cent sales tax authorized by Measure BB will begin April 1, 2022 and will extend through March 31, 2045.

- The Alameda County Transportation Commission (Alameda CTC) oversees Measure B & BB, its funding and the implementation of projects and programs by the communities that receive those funds.

- Measure B & BB funding received annually is used for local street and road improvements, paratransit operations and bicycle and pedestrian improvements.

Vehicle Registration Fee Funding

In an effort to improve the County’s transportation network, reduce traffic congestion and vehicle related pollution, Alameda County taxpayers approved a $10 per year vehicle registration fee for transportation projects.

- The ballot measure, Measure F, was overwhelmingly approved by county voters in 2012 with 63% of the vote.

- The Alameda County Transportation Commission (Alameda CTC) oversees Measure F, its funding and the implementation of projects and programs by the communities who receive those funds.

- Approximately 60% of Measure F funding is allocated directly to local agencies to be put towards the maintenance and improvement of essential transportation services and facilities.

- The City of Pleasanton applies 100% of those funds toward local streets and transportation related Capital Improvement Projects.

For additional information about how Pleasanton allocates local VRF funding, see the Measure B & VRF Brochure or Alameda County Transportation Commission.

CalRecycle Grant Funding

CalRecycle is the state’s leading authority on recycling, waste reduction and product reuse. They provide grant funding for local agencies to encourage the use of recycled and innovative products.

The City of Pleasanton received a $55,000 grant which was applied towards the Annual Resurfacing of Various City Streets, CIP 125003:

- Utilized a rubberized chip seal that contained recycled tires.

- The rubberized chip seal was placed on thirty various streets within the community

- 2,345 tires were redirected from going into landfills.

Pavement Management Program

Did you know that there are 501 lane miles of paved roads in Pleasanton? The goal of the Pavement Management Program is to maintain City streets and keep them in good driving condition, which requires a considerable amount of thought and effort.

For more information, refer to the Pavement Management Program page.

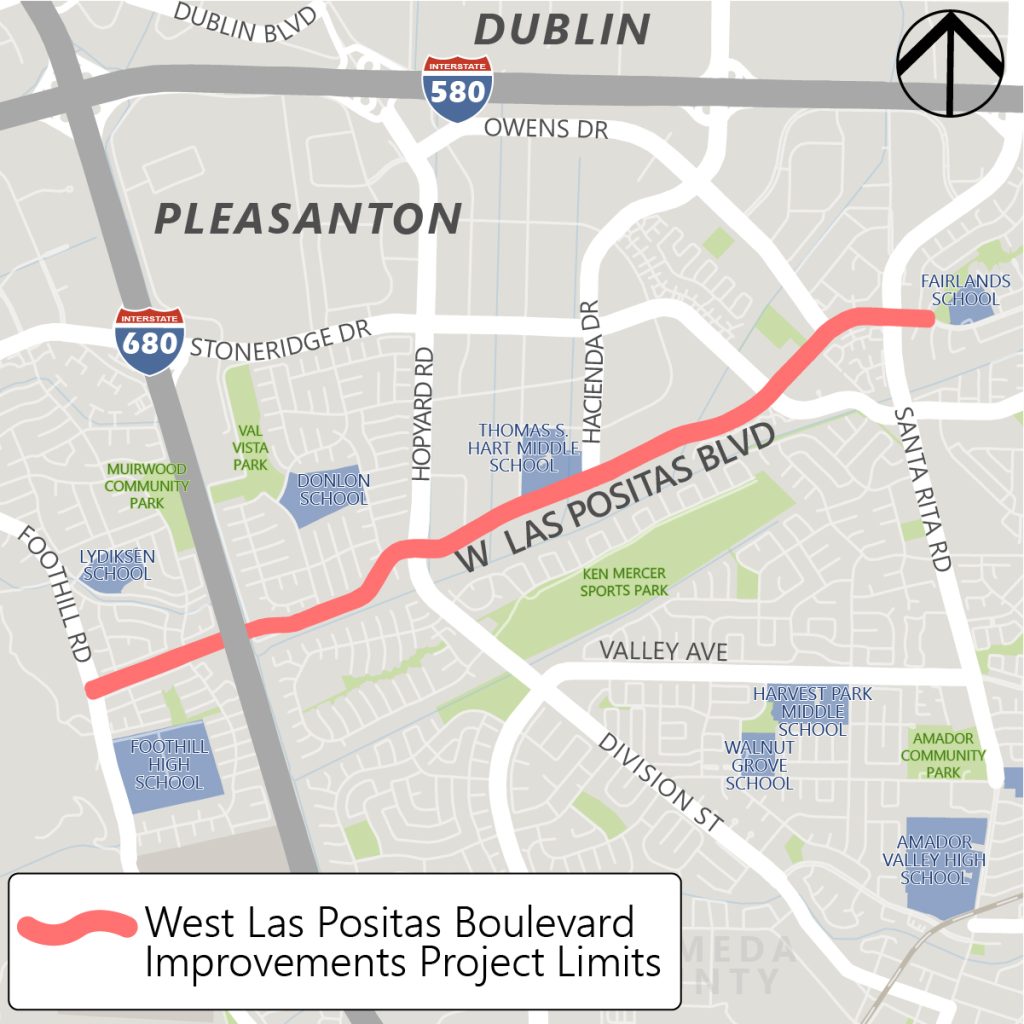

West Las Positas Multimodal Reconstruction Project

The City of Pleasanton adopted an update to the Bicycle and Pedestrian Master Plan in 2018. The updated Master Plan includes provisions to make the city more pedestrian and bicycle friendly by adopting a low-stress “all ages and abilities” infrastructure that can be used by the entire population. The Master Plan identifies the West Las Positas Boulevard corridor as the highest priority corridor for pedestrian and bicycle improvements. The Pleasanton City Council elevated the West Las Positas corridor improvements to a high-priority project in 2019 and reaffirmed its priority in 2021.

The City Council also prioritized the reconstruction of West Las Positas to fix the uneven surface along the roadway in 2021. The two high-priority projects were combined into a single project titled: THE WEST LAS POSITAS MULTIMODAL RECONSTRUCTION PROJECT.

The pedestrian and bicycle components of the West Las Positas Multimodal Reconstruction Project were developed with extensive public input and endorsed by the Bicycle, Pedestrian and Trails Committee in December 2019 and by City Council in 2022. At the November 15, 2022 City Council meeting staff was authorized to develop early phase (35% of final) design of West Las Positas and detailed cost estimates that will be presented to City Council for adoption in late summer/fall of 2023. City Council also authorized the “quick build” design using pavement markings and green delineators to provide near-term improvements around Hart Middle School.

For more information, refer to the West Las Positas Boulevard Corridor Plan page.

FAQs

What is the Treasury and Budget Division responsible for?

The Treasury Division monitors, controls, audits and invests the City’s funds. The Division is responsible for the financial administration of State/Federal Grants. The Division also issues and administers the City’s bonds and other financing instruments. This includes administering the levying and collection of assessments for various assessment districts, landscape and lighting districts and geological hazard assessment districts; ensuring accurate and timely payments to bondholders; delinquency resolution and meeting debt reporting requirements to external agencies. The Division is also responsible for the preparation and monitoring of the City’s Operating Budget and Capital Improvement Program.

What is the Accounting Division responsible for?

The Accounting Division is responsible for maintaining the general ledger accounting system. This includes processing the City’s payroll, receiving and accounting for all cash collections, paying bills, invoicing and collecting accounts receivable, posting all financial activities to the computerized ledger system and generating financial reports. This division also has responsibility for reconciling bank statements, accounting for grants and special projects, monitoring contract payments and providing financial information to others. The Division coordinates the City’s financial audits and prepares the Comprehensive Annual Financial Report and the Annual Report of Financial Transactions to the State Controller’s Office.

How do I pay an administrative citation?

Administrative Citations can be mailed to:

City of Pleasanton Finance Department

P.O. Box 520

123 Main Street

Pleasanton, CA 94566

Or call (925) 931-5400 for more payment information.

Where do I go to pay for a business license?

Where do I pay for a parking citation?

Where do I pay for my property taxes?

How do I pay a Tourism Assessment?

Tourism Assessments can be mailed to:

City of Pleasanton Finance Department

P.O. Box 520

123 Main Street

Pleasanton, CA 94566

Or call (925) 931-5417 for more information.

How do I pay a Transient Occupancy Tax?

Transient Occupancy Tax can be mailed to:

City of Pleasanton Finance Department

P.O. Box 520

123 Main Street

Pleasanton, CA 94566

Or call (925) 931-5407 for more information.

How do I pay a water bill?

Administration Hours

Finance Department

Director of Finance, Susan Hsieh

123 Main Street

PO Box 520

Pleasanton, CA 94566

Monday – Friday, 8:00 a.m. – 5:00 p.m.

(925) 931-5400

Learn more about our Department, Our Team and Services.

Contact us by filling out the form below: